With tax season underway, many Americans are hoping for a larger refund in 2026. While refunds depend on income, withholding, and credits claimed, there are several legal strategies that could increase the amount you receive this year.

Understanding how refunds are calculated — and how to maximize eligible credits — can help you keep more of your money.

Why Refunds May Be Bigger in 2026

Refunds increase when taxpayers:

- Had more taxes withheld than necessary

- Qualify for expanded tax credits

- Report deductible expenses accurately

- Experience changes in income or family size

The Internal Revenue Service calculates refunds based on total tax owed minus payments and credits applied. If you paid more than required throughout the year, you receive the difference back.

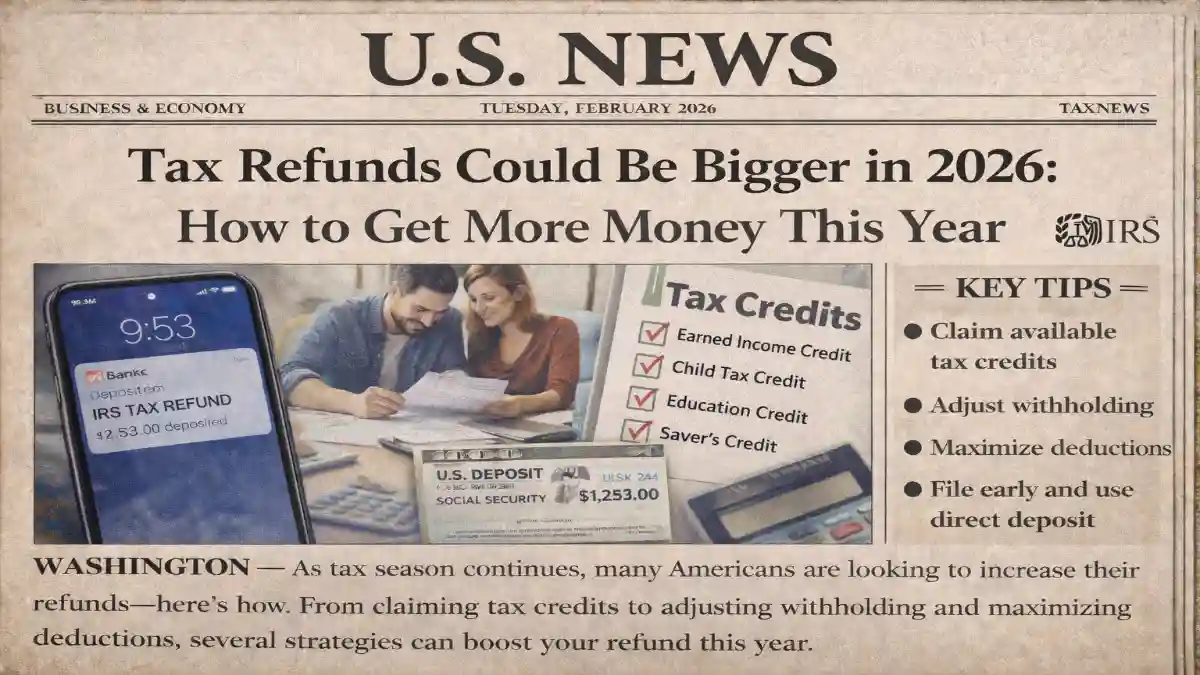

Claim All Available Tax Credits

Tax credits directly reduce your tax bill and can significantly boost refunds. Some of the most valuable credits include:

- Earned Income Tax Credit

- Child Tax Credit

- Education credits

- Saver’s Credit for retirement contributions

Refundable credits are especially important because they can increase your refund even if your tax liability is already reduced to zero.

Adjust Your Withholding Strategically

If you expect a larger refund this year, review your W-4 form with your employer. Adjusting withholding ensures you’re paying the right amount of tax throughout the year.

While a bigger refund may feel like a bonus, remember that it usually means you overpaid taxes during the year.

Maximize Deductions

Tax deductions reduce taxable income, which can increase refunds. Consider:

- Student loan interest

- Mortgage interest

- Charitable contributions

- Medical expenses exceeding thresholds

- Self-employed business expenses

Keeping accurate records throughout the year makes claiming deductions easier.

Contribute to Retirement Accounts

Contributions to traditional IRAs or certain retirement plans may reduce taxable income. Lower taxable income can translate into a higher refund if you’ve already paid sufficient taxes during the year.

Additionally, some taxpayers may qualify for the Saver’s Credit when contributing to retirement accounts.

File Early and Choose Direct Deposit

Filing electronically and selecting direct deposit helps you receive refunds faster. Early filing also reduces the risk of identity fraud and processing delays.

Accuracy is critical — errors can slow down refunds and reduce the amount issued.

Avoid Common Refund Mistakes

To protect your refund:

- Double-check Social Security numbers

- Confirm bank account details

- Ensure income forms match official records

- Respond promptly to IRS notices

Small mistakes can delay or reduce your refund.

Should You Aim for a Bigger Refund?

While many taxpayers prefer larger refunds, some financial experts recommend adjusting withholding to receive more money in each paycheck instead.

Ultimately, the goal is not just a larger refund — but paying the correct amount of tax while maximizing eligible credits and deductions.

Final Thoughts

Tax refunds in 2026 could be bigger for some Americans, especially those who qualify for valuable credits and deductions. By reviewing eligibility, filing accurately, and planning ahead, you can legally increase your refund and make the most of this tax season.