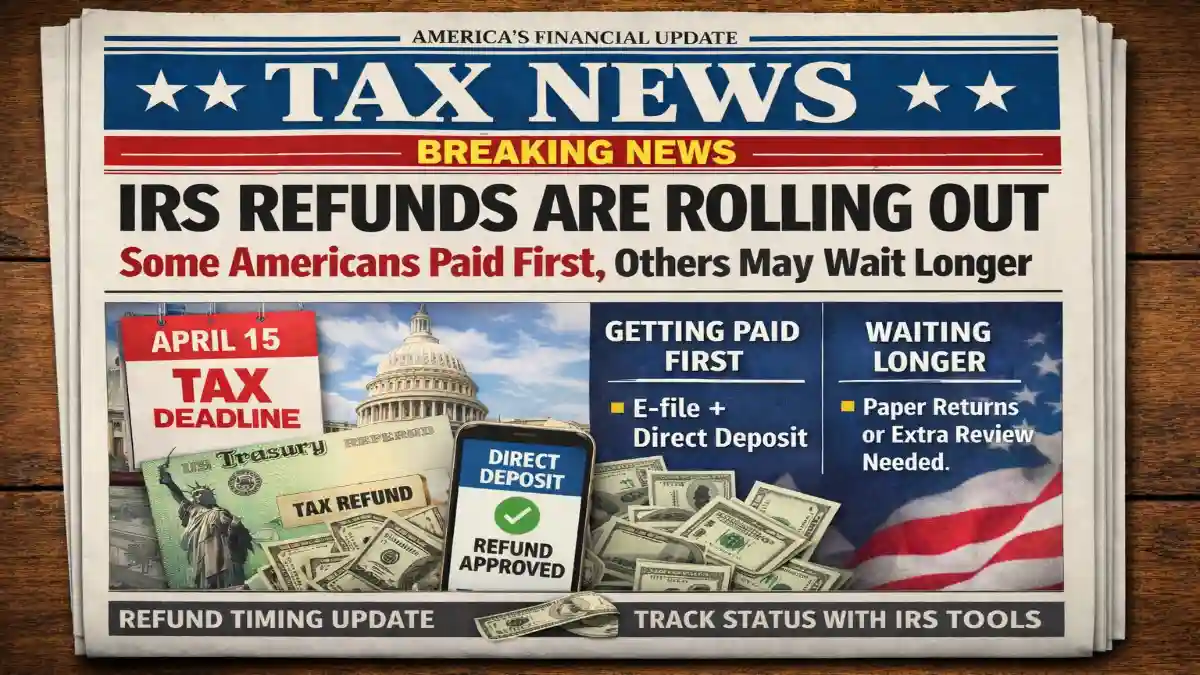

The Internal Revenue Service has started releasing tax refunds as the filing season progresses, but not all Americans will receive their payments at the same time. Refunds are being issued in phases, which means some taxpayers are paid quickly while others may experience longer wait times.

Why Some Americans Are Paid First

Taxpayers who filed electronically and selected direct deposit are typically the first to receive refunds. Electronic returns move through IRS systems faster, and direct deposit eliminates mailing delays. Early filers with accurate, straightforward returns are often processed sooner.

Returns that do not require extra verification or review are approved more quickly, allowing payments to be released earlier.

Why Others May Have to Wait Longer

Some refunds take additional time due to review requirements. Returns that include refundable tax credits, income adjustments, or mismatches between reported income and employer records may need extra verification. These checks help prevent errors and improper payments.

Paper-filed and amended returns also take longer because they require manual processing, which slows approval and payment.

How Filing Method Affects Refund Timing

Filing method plays a major role in how quickly refunds arrive:

- E-file + direct deposit: Usually the fastest option

- E-file + paper check: Processing may be quick, but mailing adds time

- Paper return: Often takes several weeks longer

Even after a refund is sent, banks may take additional time to post deposits.

When Refunds Are Expected to Arrive

Most electronic filers who choose direct deposit receive refunds within up to 21 days after their return is accepted. Returns accepted earlier in the season often see faster payments, while later or reviewed returns may be paid weeks afterward.

There is no single nationwide refund date. Payments continue to roll out throughout the tax season.

How to Check Your Refund Status

Taxpayers can track their refund using official IRS tracking tools. Status updates typically show when a return has been received, approved, and sent, and are refreshed once per day.

A status showing “processing” means the return is still under review and does not automatically indicate a problem.

What Taxpayers Should Do While Waiting

To avoid further delays, taxpayers should not file duplicate returns or submit unnecessary amendments. Make sure personal details and bank information are accurate, and respond promptly if the IRS requests additional documentation.

What to Expect Next

Refund payments will continue to be released as returns complete processing. While some Americans will see payments arrive quickly, others may need to wait longer depending on filing method and review status.

Staying informed and checking refund status through official channels is the best way to know when your IRS refund is likely to arrive.