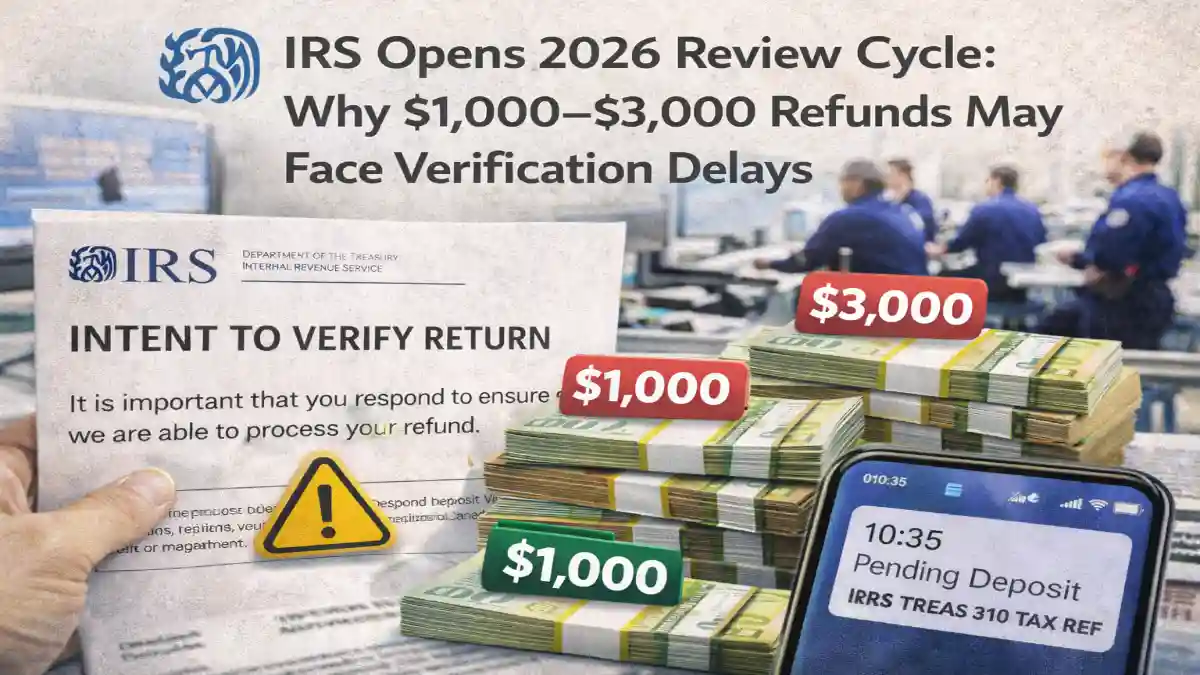

As the 2026 tax season progresses, the Internal Revenue Service has entered its routine review cycle — a process that can temporarily delay certain refunds. Taxpayers expecting refunds between $1,000 and $3,000 may see additional verification steps before their payments are released.

While most refunds are processed within the standard timeline, mid-sized refunds often trigger automated checks designed to prevent fraud and ensure accuracy.

What Is the IRS Review Cycle?

The Internal Revenue Service uses automated systems to screen tax returns for errors, identity risks, and credit eligibility issues. Each year, as refund volumes increase, the IRS intensifies its review process to reduce fraudulent payments and incorrect claims.

The 2026 review cycle is part of normal processing procedures and does not necessarily indicate wrongdoing by taxpayers.

Why $1,000–$3,000 Refunds May Be Flagged

Refunds in this range often include refundable credits such as:

- Earned Income Tax Credit

- Additional Child Tax Credit

- Education credits

Because these credits can significantly increase refund totals, the IRS may conduct extra verification before approving payment.

Automated systems may flag returns for review if:

- Income reported does not match employer data

- Withholding amounts appear inconsistent

- Multiple credits are claimed together

- Identity verification is required

How Long Could Delays Last?

For most taxpayers, refunds are issued within approximately 21 days of acceptance when filed electronically with direct deposit. However, returns selected for review may take several additional weeks.

If identity verification is required, the IRS may send a letter requesting confirmation before releasing funds.

How to Know If Your Refund Is Under Review

Taxpayers can monitor refund status through the IRS refund tracking system. If your status does not move from “Return Received” to “Refund Approved” within the standard timeframe, your return may be undergoing additional review.

Receiving an official IRS letter requesting verification is another sign your refund is temporarily on hold.

How to Avoid Refund Delays

To reduce the likelihood of review-related delays:

- File electronically

- Double-check income and withholding details

- Ensure Social Security numbers match official records

- Respond quickly to IRS correspondence

Accuracy remains the most important factor in preventing processing issues.

Should Taxpayers Be Concerned?

In most cases, review cycles are precautionary and part of the IRS’s fraud prevention strategy. Many refunds are released once verification steps are completed.

Delays can be frustrating, but they are often temporary and resolved without further action beyond confirmation requests.

Final Takeaway

The IRS 2026 review cycle may result in additional verification for refunds between $1,000 and $3,000, particularly when refundable credits are involved. While most taxpayers will still receive refunds within the typical processing window, some may experience short delays.

Staying informed, filing accurately, and responding promptly to any IRS notices are the best ways to ensure your refund arrives as smoothly as possible.