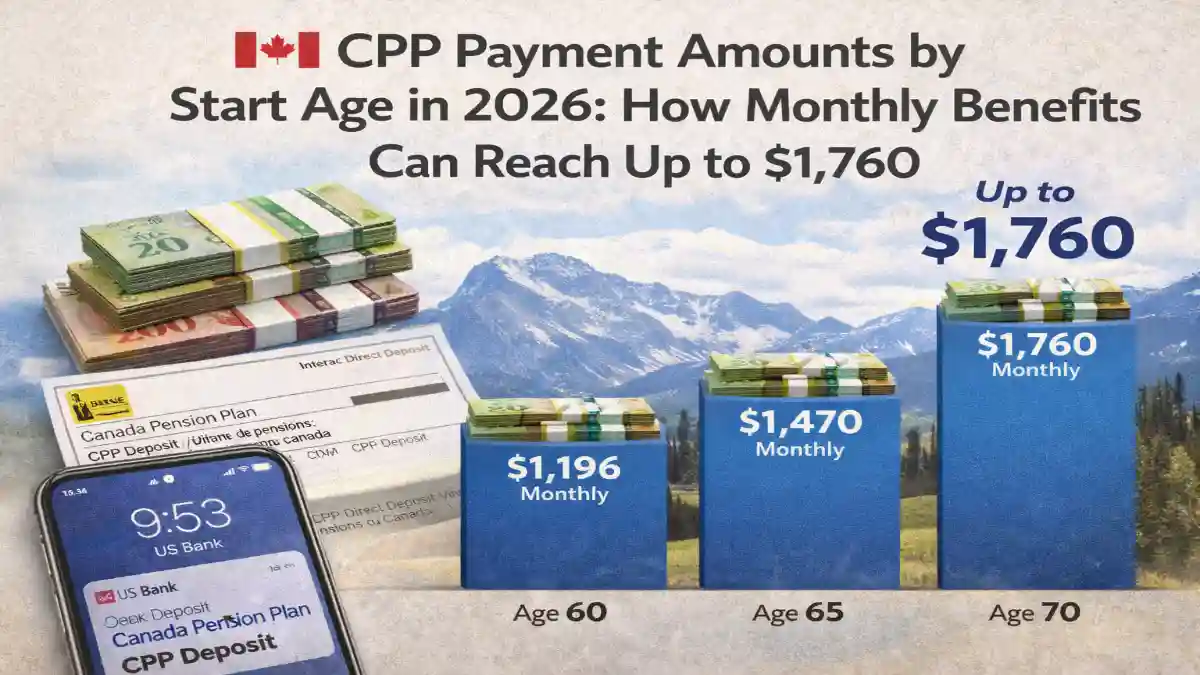

Choosing when to start your Canada Pension Plan (CPP) benefits is one of the most important retirement decisions you will make. In 2026, maximum monthly CPP payments can reach up to $1,760 for eligible contributors who delay benefits and qualify under enhanced CPP rules.

Here’s how CPP payments change based on your starting age and what that means for your monthly retirement income.

How CPP Start Age Affects Your Payment

The Canada Pension Plan allows retirees to begin collecting benefits as early as age 60 or as late as age 70. However, the monthly amount you receive depends heavily on when you start.

Starting earlier reduces your monthly payment permanently, while delaying increases it.

If You Start at Age 60

You can begin CPP as early as 60, but your payment is reduced by up to 36 percent compared to starting at 65. This reduction applies for life.

This option may appeal to those who need income sooner or plan to retire early, but it results in smaller monthly payments.

If You Start at Age 65

Age 65 is considered the standard start age. At this point, you receive 100 percent of your calculated CPP benefit based on your lifetime contributions.

Many retirees choose this option because it balances early access with full base benefits.

If You Delay to Age 70

For every month you delay CPP after age 65, your payment increases by 0.7 percent, up to a maximum 42 percent boost at age 70.

Delaying until 70 can significantly raise your monthly benefit. Under enhanced CPP contributions introduced in recent years, maximum benefits in 2026 may reach up to $1,760 per month for high contributors who delay to 70.

What Determines Your Exact CPP Amount

While start age plays a major role, your actual CPP payment also depends on:

- Total years worked and contributed

- Contribution amounts during working years

- Average lifetime earnings

- Participation in the enhanced CPP program

Not everyone will receive the maximum amount, as it requires consistent maximum contributions over many years.

Is Delaying CPP Always Better?

Delaying CPP increases monthly income, but it may not be the right choice for everyone. Factors to consider include:

- Your health and life expectancy

- Other sources of retirement income

- Employment plans after age 65

- Immediate financial needs

For individuals expecting a long retirement, delaying may result in higher lifetime payouts.

CPP Enhancements in 2026

The CPP enhancement program gradually increased contribution rates and future benefits. Retirees who contributed under the enhanced structure may qualify for higher monthly payments compared to previous generations.

This is one reason why some 2026 maximum payments are higher than in earlier years.

Final Thoughts

CPP payments in 2026 vary significantly depending on when you start collecting benefits. Beginning at 60 results in lower monthly income, while delaying until 70 can push payments toward the $1,760 maximum for eligible contributors.

Understanding how start age impacts your retirement income helps you make informed financial decisions and build a more secure retirement plan.