The Internal Revenue Service has outlined how tax refunds will be processed during the 2026 filing season. While refunds are not issued on a single nationwide date, understanding expected timelines, how refund amounts are calculated, and what affects processing time can help taxpayers set realistic expectations.

How the IRS Tax Refund Schedule Works in 2026

IRS refunds are issued on a rolling basis after a tax return is accepted and processed. Most taxpayers who file electronically and choose direct deposit receive refunds within up to 21 days of acceptance. Returns that require additional review or are filed on paper typically take longer.

Your individual refund date depends on:

- When your return is accepted

- Whether verification or review is required

- The refund method you selected

Expected IRS Refund Dates for 2026

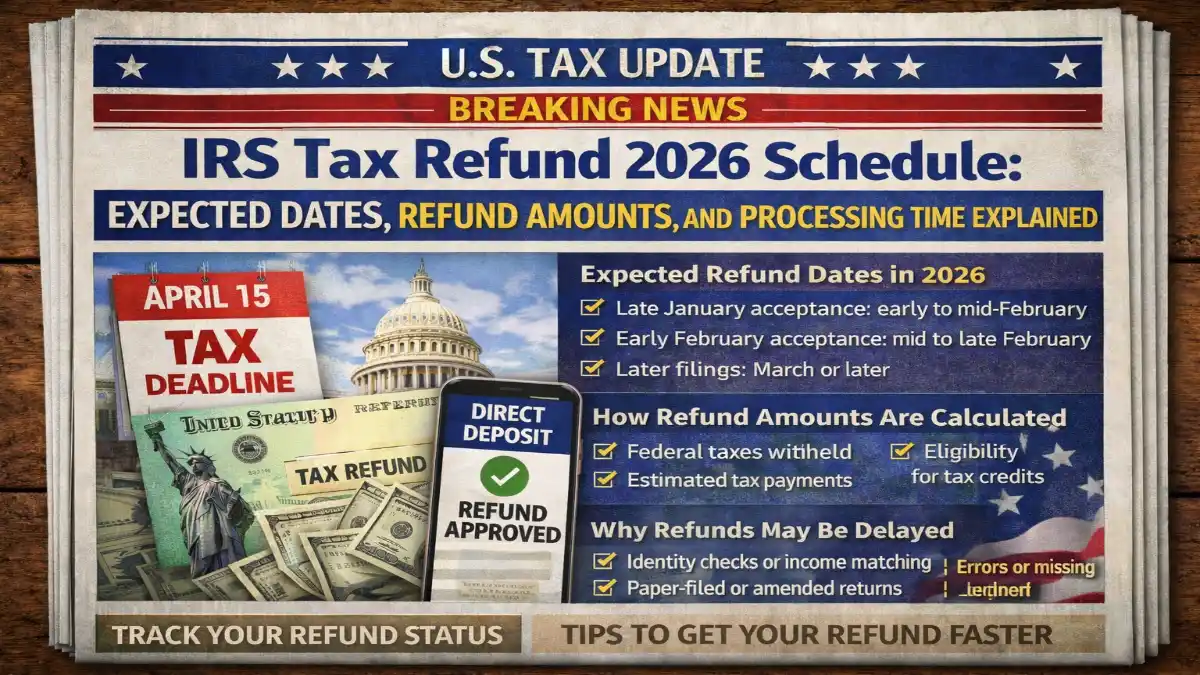

While exact dates vary by filer, common refund windows include:

- Late January acceptance: refunds often arrive in early to mid-February

- Early February acceptance: refunds commonly arrive mid to late February

- Later filings: refunds may arrive in March or later

Weekends, federal holidays, and bank processing times can affect when funds appear in your account.

How IRS Refund Amounts Are Calculated

There is no fixed refund amount for all taxpayers. Refund totals are calculated individually based on:

- Federal income tax withheld during the year

- Estimated tax payments made

- Eligibility for refundable tax credits

- Filing status, income level, and deductions

Some taxpayers receive larger refunds due to over-withholding or refundable credits, while others may receive smaller refunds or owe taxes instead.

Direct Deposit vs. Paper Check Processing Time

Direct deposit is the fastest way to receive an IRS refund. Once the IRS releases the payment, banks typically post deposits within one to three business days.

Paper checks take longer due to printing and mailing, often adding extra weeks after approval.

What Can Delay a Refund in 2026

Refunds may take longer if a return includes:

- Identity verification or income matching checks

- Refundable tax credit claims

- Errors or missing information

- Amended or paper-filed returns

A refund status showing “processing” generally means the return is under review and does not automatically indicate a problem.

How to Track Your IRS Refund

Taxpayers can monitor refund progress using official IRS tracking tools. Refund status usually updates once per day and shows whether a return has been received, approved, or sent.

Checking more frequently does not speed up processing.

Tips to Get Your Refund Faster

To improve the chances of receiving a refund sooner:

- File electronically

- Choose direct deposit

- Double-check personal and income details

- Avoid duplicate filings or unnecessary amendments

- Respond promptly to any IRS requests

2026 Tax Refund Outlook

The IRS expects refund processing to continue steadily throughout the 2026 tax season. While many taxpayers will receive refunds within the standard timeframe, some may experience delays due to verification or filing method.